2022 tax refund calculator canada

We are a community of solvers combining human ingenuity experience and technology innovation to deliver sustained outcomes and build trust. For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205.

Property Tax Calculator Estimator 2022 Wowa Ca

You can also create your new 2022 W-4 at the end of the tool on the tax return.

. The Canada Tax Calculator by iCalculator is designed to allow detailed salary and income tax calculations for each province in Canada. The tax rates for Ontario in 2022 are as follows. The amount of income tax that was deducted from your paycheque.

Personal tax calculator. For your 2022 income if your base provincial tax is up to. Federal income tax rates in 2022 range from 15 to 33.

2022 Income Tax in Canada is calculated separately for Federal tax commitments and Province Tax commitments depending on where the individual tax return is filed in 2022 due to work. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. Ontario income tax rates in 2022 range from 505 to 1316.

2022 free Alberta income tax calculator to quickly estimate your provincial taxes. Check how much taxes you need to pay on CERB CRSB CESB CRB and much more. If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software.

This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. 2022 Personal tax calculator. FREE- Simple tax calculator to quickly estimate your Canadian Income Tax for 2022.

The calculator reflects known rates as of June 1 2022. Finally earnings above 220000 will be taxed at a rate of 1316. That means that your net pay will be 37957 per year or 3163 per month.

Calculate the tax savings. Use the Canada Tax Calculator by entering your. The Ontario surtax is more complex so the calculation takes a few more steps which youll see in the table below.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Earnings 150000 up to 220000 the rates are 1216. Calculate your combined federal and provincial tax bill in each province and territory.

TurboTax Free customers are entitled to a payment of 999. If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. TurboTax Free customers are entitled to a payment of 999.

Calculate your combined federal and provincial tax bill in each province and territory. This means that you are taxed at.

2022 Tax Day What To Know About This Year S Tax Deadline And Refunds Nbc Chicago

Yearly Federal Tax Calculator 2023 24 2023 Tax Refund Calculator

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

International Student Tax Return And Refund

H R Block Tax Calculator Free Refund Estimator 2022

Small Business Tax Returns In Canada 2022 Revenues Profits

Massachusetts Tax Refund 2022 Checks Going Out Tuesday Nbc Boston

Average Earned Personal Income Grows In July 2022 Seeking Alpha

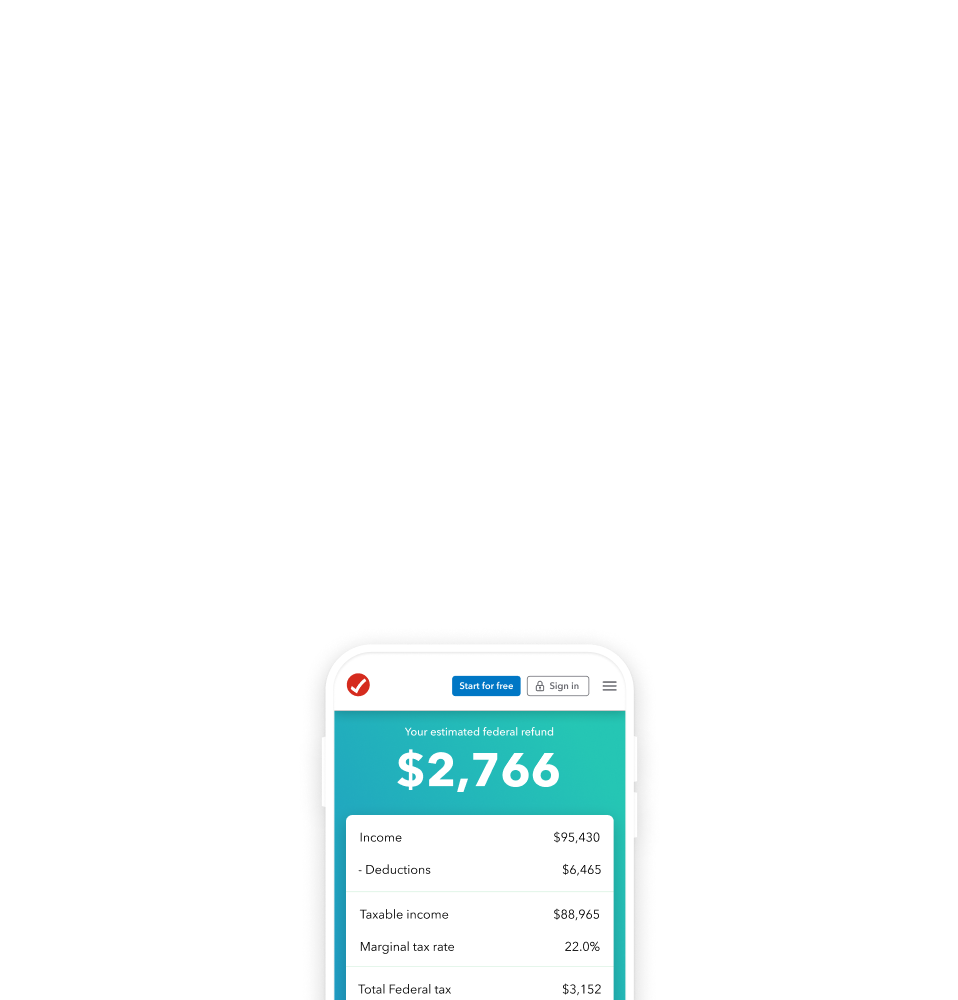

Free Tax Calculators Money Saving Tools 2021 2022 Turbotax Official

Federal Income Tax Return Calculator Nerdwallet

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

Rrsp Hi Res Stock Photography And Images Alamy

Ey 2022 Tax Calculators Rates Ey Canada

How To File Income Tax Return To Get Refund In Canada 2022

What Is The Tax Reform Act Expat Tax Online

What Is A Canada Rit Deposit Unexpected Surprise Deposits F